The financial world has changed dramatically in the last decade. Traditional banks are no longer the only option for personal loans, small business financing, or even investment opportunities. LendingClub was one of the pioneers of the peer-to-peer lending model in the U.S., and today it continues to help borrowers find affordable credit while giving investors access to new opportunities.

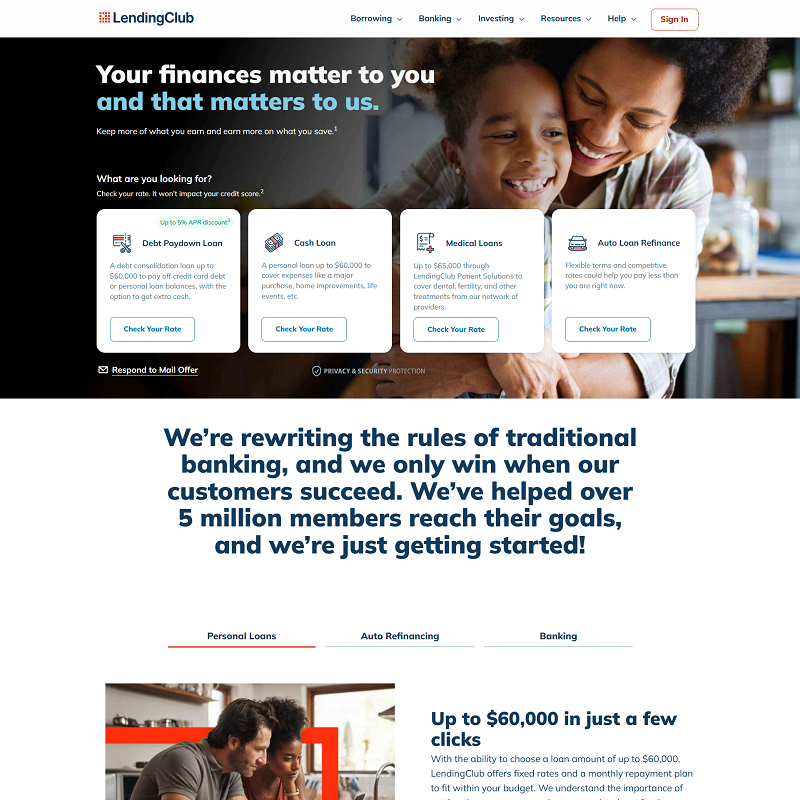

What Is LendingClub?

LendingClub started as a peer-to-peer platform, directly connecting borrowers with investors. Over time, it evolved into a full-scale online lending marketplace. Today, it offers personal loans, auto refinancing, small business loans, and patient financing — all without the long wait times and red tape of traditional banks.

Why People Choose LendingClub

Borrowers are often drawn to LendingClub because:

- The application process is online and quick.

- Pre-qualification does not affect your credit score.

- Interest rates are often lower than credit cards.

- Loan terms are clear, with no hidden fees.

On the flip side, investors once loved it for the chance to diversify into consumer lending — though in recent years, LendingClub has shifted more toward being a digital bank.

LendingClub Loan Options

LendingClub offers several products tailored to different financial needs:

- Personal Loans – For debt consolidation, home improvements, or major purchases.

- Auto Refinance Loans – Helps reduce car payments by securing lower interest rates.

- Small Business Loans – Designed for entrepreneurs needing working capital.

- Patient Solutions – Financing for healthcare and medical procedures.

This wide range of products makes LendingClub a versatile choice for many U.S. consumers.

The Borrowing Process

Applying for a LendingClub loan is straightforward:

- Fill out an online application and check your rate.

- Compare loan offers without hurting your credit score.

- Accept the best option and get funded, sometimes in just a few days.

It’s a streamlined process compared to traditional lenders, which often require long meetings and stacks of paperwork.

Who Should Consider LendingClub?

- Borrowers with good to excellent credit looking for lower rates.

- People consolidating high-interest credit card debt.

- Small business owners who want fast, online approval.

- Car owners who want to refinance without hassle.

| Pros | Cons |

| 1. Fast online application and approval. 2. Transparent fees and terms. 3. Multiple loan types for personal and business needs. 4. Good reputation as one of the first peer-to-peer lenders. | 1. Not the best rates for borrowers with poor credit. 2. Availability of loans may vary by state. 3. Investors no longer have the same direct lending access as in the early years. |

Final Thoughts

LendingClub helped revolutionize the way Americans borrow money. While it has moved away from its original peer-to-peer model, it remains a strong alternative to traditional banks. For borrowers who value convenience, clear terms, and the possibility of better rates than credit cards, LendingClub is a platform worth considering.

No Comments

Leave a comment Cancel