Applying for a mortgage has traditionally been a stressful and slow process. Rocket Mortgage, launched by Quicken Loans, set out to change that by creating a simple, digital-first mortgage experience. Today, it’s one of the most popular mortgage lenders in the U.S., serving millions of borrowers who want speed, transparency, and convenience.

What Is Rocket Mortgage?

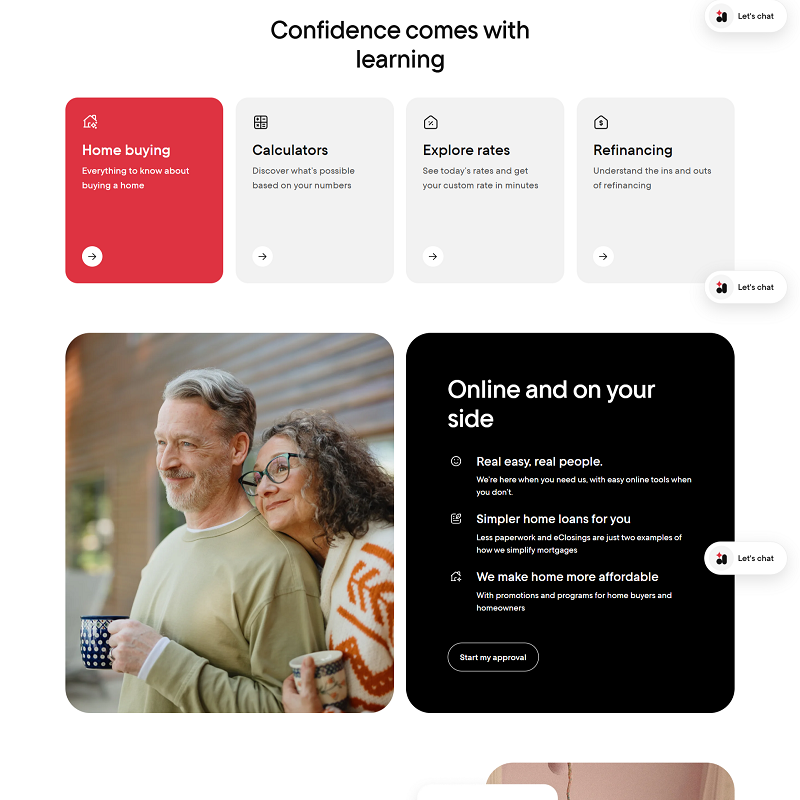

Rocket Mortgage is an online mortgage platform that streamlines the entire borrowing process. Instead of visiting a bank, applicants can get pre-approved, upload documents, and manage their loan entirely online. With its strong reputation and powerful technology, Rocket Mortgage is a go-to choice for both first-time buyers and experienced homeowners.

Key Features of Rocket Mortgage

Rocket Mortgage stands out in the crowded mortgage industry for several reasons:

- Fully Digital Process – Apply and manage your mortgage through an app or website.

- Quick Pre-Approval – Receive pre-approval in minutes, helping buyers compete in hot markets.

- Wide Range of Loan Options – Conventional, FHA, VA, jumbo loans, and refinancing.

- Strong Customer Support – While digital-first, phone and online support are always available.

- Integration With Quicken Loans Expertise – Backed by one of the biggest names in lending.

How Rocket Mortgage Works

The process is designed to be as fast and stress-free as possible:

- Online Application – Fill out basic information and start your application.

- Credit & Financial Check – Rocket Mortgage verifies income, assets, and credit quickly.

- Loan Options – Compare personalized loan recommendations instantly.

- Approval & Closing – Complete closing online or with hybrid in-person support.

This approach has made Rocket Mortgage especially appealing to tech-savvy buyers.

Who Should Consider Rocket Mortgage?

Rocket Mortgage works well for:

- First-time homebuyers who want guidance and simplicity.

- Busy professionals who prefer an app-based experience.

- Veterans and FHA borrowers seeking government-backed loans.

- Homeowners looking to refinance quickly and easily.

| Pros | Cons |

| 1. Fast approval and easy digital access 2. Wide variety of loan programs 3. Backed by Quicken Loans’ experience and resources 4. 24/7 access through the app or website | 1. Rates may not always be the lowest compared to smaller lenders 2. Closing costs can vary depending on the loan type |

Final Thoughts

Rocket Mortgage has become a household name in the U.S. mortgage industry for good reason. Its blend of technology, speed, and reliability makes it an excellent choice for many borrowers. If you’re comfortable managing your mortgage online and want a trusted, fast-moving lender, Rocket Mortgage could be the right partner for your home financing journey.

No Comments

Leave a comment Cancel