When most people hear the word GEICO, they immediately picture the little green gecko on TV. The company’s advertising has become iconic, but what makes GEICO stand out isn’t just its commercials—it’s how it built a reputation for affordable, reliable coverage that millions of Americans depend on.

The Power of Accessibility

GEICO made its mark by focusing on accessibility. It recognized early on that customers wanted fast quotes, low rates, and easy service without unnecessary hassle. Instead of building a large network of local offices, GEICO invested in technology, phone support, and later, digital platforms.

Today, a customer can:

- Get an insurance quote in minutes online.

- File and track claims directly from the GEICO mobile app.

- Use 24/7 roadside assistance without calling an agent.

This commitment to convenience reshaped the insurance industry.

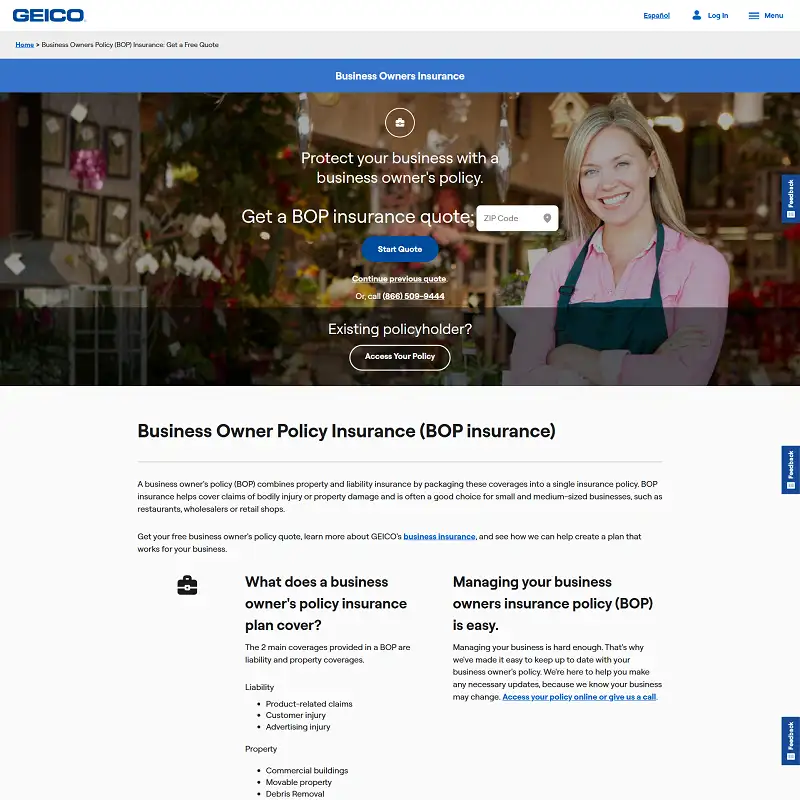

Beyond Auto Insurance

While most people know GEICO for car insurance, the company actually covers much more. From homes to boats, and even pets, GEICO has positioned itself as a one-stop insurance provider.

Some of the products include:

- Auto, Motorcycle, and RV Insurance

- Homeowners, Renters, and Condo Coverage

- Pet Insurance

- Business Liability and Commercial Auto

Instead of being just “the car insurance company,” GEICO has evolved into a brand that meets different lifestyle needs.

Why People Choose GEICO

The reasons people stick with GEICO often come down to two things: affordability and simplicity.

Many drivers report saving hundreds each year by switching. And the company’s discounts—ranging from safe driver rewards to federal employee benefits—make it even easier to cut costs.

But it’s not only about price. GEICO’s digital-first approach means that a driver in New York and a homeowner in California get the same level of quick, reliable service.

Pros and Cons of GEICO

Pros:

- Affordable auto insurance rates with nationwide availability.

- Easy-to-use digital tools and a highly rated mobile app.

- Wide range of discounts, including military and federal employee perks.

- Backed by Berkshire Hathaway, ensuring financial stability.

Cons:

- Limited local agents, so in-person service is rare.

- Home and renters policies often come from partner companies.

- Claim satisfaction varies depending on region and case.

Final Word

GEICO’s rise isn’t just about clever marketing—it’s about listening to what people want from their insurance company: fair prices, easy access, and dependable service. That’s why millions of Americans turn to GEICO not just for their cars, but for protection across many aspects of their lives.

No Comments

Leave a comment Cancel