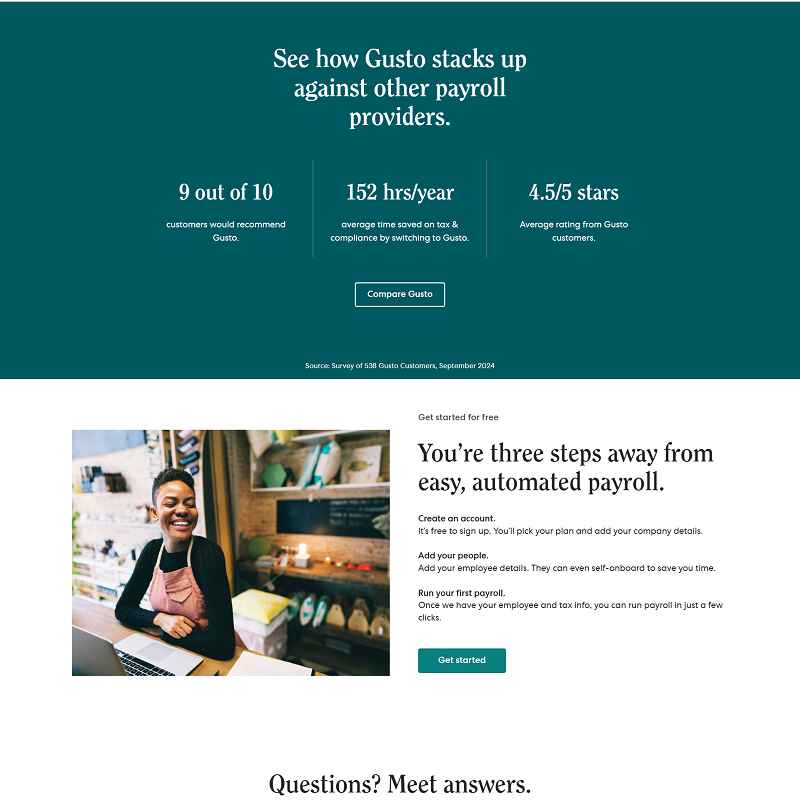

When small business owners think about payroll, they often imagine endless tax forms, complicated calculations, and late-night headaches. Gusto was built to change that. Designed with startups and small companies in mind, it combines payroll, benefits, and HR tools in a clean, user-friendly platform.

Why Gusto Is Popular Among Small Businesses

One of the main reasons entrepreneurs love Gusto is its simplicity. You don’t need to be an HR expert to use it. The dashboard is straightforward, the onboarding process is quick, and most of the heavy lifting — from tax filings to direct deposit — is automated.

Business owners often highlight three key benefits:

- It saves time by automating payroll and filings.

- Employees get self-service access to their pay stubs and tax forms.

- It integrates smoothly with accounting and time-tracking apps.

Core Features You’ll Get with Gusto

Gusto isn’t just about sending paychecks. It’s a full platform for managing your team:

- Payroll Automation – Run unlimited payrolls, process contractor payments, and stay compliant with tax rules.

- Benefits Management – Offer health insurance, retirement plans, and even commuter benefits.

- Employee Self-Service – Workers can onboard, update info, and access documents without bothering HR.

- Integrations – Works with tools like QuickBooks, Xero, and popular time-tracking apps.

- Tax Compliance – Gusto automatically files federal, state, and local payroll taxes.

Who Should Use Gusto?

Gusto is especially helpful for:

- Startups that want to look professional from day one.

- Small businesses with a mix of full-time staff and contractors.

- Owners who don’t want to spend hours learning payroll rules.

- Companies that need a simple HR tool without enterprise complexity.

Pricing

Unlike some payroll providers, Gusto publishes its pricing clearly. It charges a base monthly fee plus a per-employee fee, with different tiers depending on whether you only need payroll or also want HR and benefits tools. For small companies, this transparency makes budgeting easier.

Advantages at a Glance

- Clean, modern interface

- Affordable for small businesses

- Clear pricing without hidden fees

- Good customer support

But it’s not perfect. Larger companies may outgrow Gusto’s features, and it doesn’t have the same depth of compliance tools as enterprise-focused platforms like ADP.

| Pros | Cons |

| 1. Simple to set up and use 2. Automated tax filings included 3. Benefits administration at small-business rates | 1. May lack advanced features for large corporations 2. Limited international payroll options |

Final Thoughts

For small and midsize businesses in the U.S., Gusto Payroll strikes an excellent balance between affordability and functionality. It saves time, reduces errors, and gives employees a professional experience. If you’re tired of juggling payroll spreadsheets or stressing over tax deadlines, Gusto might be the stress-free solution you’ve been searching for.

No Comments

Leave a comment Cancel