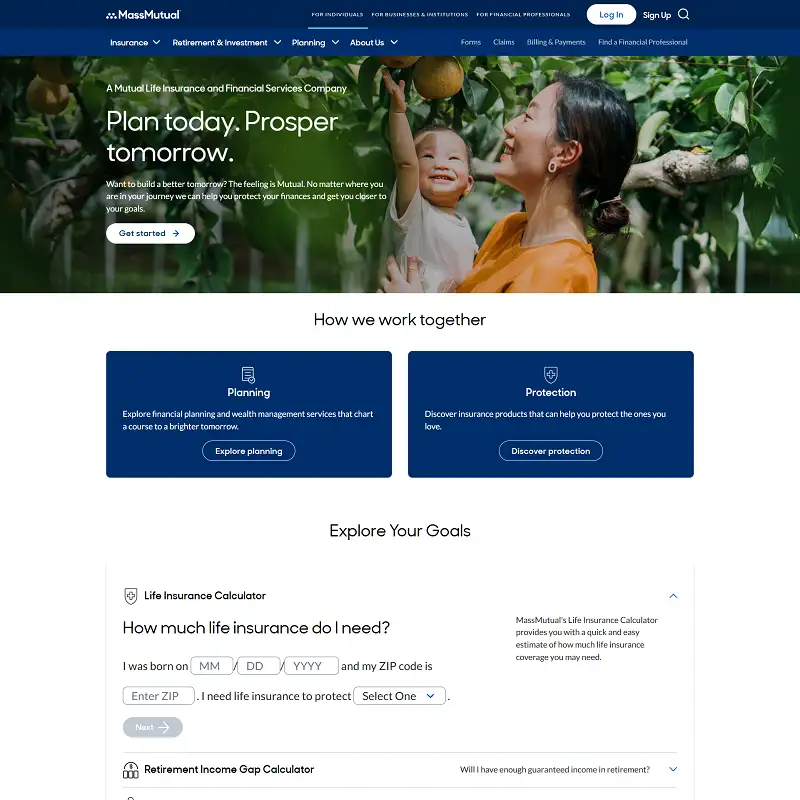

When it comes to protecting your family’s financial future, few names carry as much weight as MassMutual. With over 170 years of experience, this Fortune 500 company has become a symbol of stability and reliability in the world of life insurance and financial services. Whether you’re planning for retirement, investing for the long term, or ensuring your loved ones are protected, MassMutual combines experience, innovation, and trust like few others in the industry.

A Quick Look at MassMutual

Founded in 1851, the Massachusetts Mutual Life Insurance Company (MassMutual) is one of the oldest and most respected insurers in the United States. Based in Springfield, Massachusetts, the company has built its reputation on mutual ownership — meaning it operates for the benefit of its policyholders, not shareholders.

This customer-first approach has allowed MassMutual to remain focused on long-term value, financial strength, and steady growth — ensuring that policyholders are always the top priority.

What MassMutual Offers

MassMutual provides a wide range of financial products and services, including:

- Life Insurance – Term life, whole life, and universal life coverage for individuals and families.

- Disability Income Insurance – Protects your income if you’re unable to work due to illness or injury.

- Retirement Planning – 401(k) plans, IRAs, and annuities to secure your financial future.

- Investment Services – Mutual funds, brokerage accounts, and wealth management.

- College Savings Plans – Tools to help families prepare for education expenses.

- Business Solutions – Employee benefits, business succession planning, and executive insurance options.

With this broad portfolio, MassMutual serves individuals, families, and businesses alike — offering tailored financial strategies for every stage of life.

How MassMutual Works

MassMutual combines personalized financial planning with modern digital tools. Customers can connect with licensed financial professionals for in-depth advice or explore their insurance and investment options online.

Its whole life policies are particularly popular, offering lifetime coverage, guaranteed cash value, and potential dividends — a hallmark of mutual insurance companies. The company also provides a robust online portal, allowing users to manage their policies, make payments, and monitor investment performance with ease.

In short, MassMutual delivers both human expertise and digital convenience — helping customers make informed decisions about their financial well-being.

Who Should Consider MassMutual

MassMutual is ideal for:

- Individuals seeking long-term financial protection through whole life insurance.

- Families looking for reliable income replacement or education savings plans.

- Professionals who want disability income coverage for added security.

- Business owners in need of employee benefits or succession planning.

- Investors who prefer stable, well-managed financial products.

Its offerings suit anyone focused on long-term growth and security rather than short-term gains.

Why People Choose MassMutual

The biggest reason people choose MassMutual is trust. With more than a century and a half of proven performance, the company has survived wars, recessions, and changing markets — always maintaining financial strength and customer loyalty.

MassMutual’s mutual ownership structure means profits are reinvested for the benefit of policyholders, not Wall Street. This results in stronger dividends, better service, and a true sense of partnership between the company and its customers.

Beyond products, MassMutual stands out for its commitment to education — providing financial literacy resources and planning tools that empower people to make smarter money decisions.

Pros and Cons of MassMutual

Pros:

- Over 170 years of experience and financial strength.

- Mutual company — owned by policyholders, not shareholders.

- Wide range of insurance, retirement, and investment options.

- Strong dividend history for whole life policies.

- Excellent customer support and financial education resources.

Cons:

- Some products require working with an agent (limited direct purchase options).

- Premiums can be higher than smaller or newer insurers.

- Online tools are improving but still not as advanced as fintech-focused competitors.

Final Thoughts

MassMutual isn’t just another insurance company — it’s a financial partner that’s stood the test of time. With its powerful combination of tradition, reliability, and customer focus, it continues to help millions of Americans protect what matters most and plan for the future with confidence.

If you’re looking for a trusted name in life insurance and financial planning, MassMutual is one of the safest, smartest choices you can make.

No Comments

Leave a comment Cancel