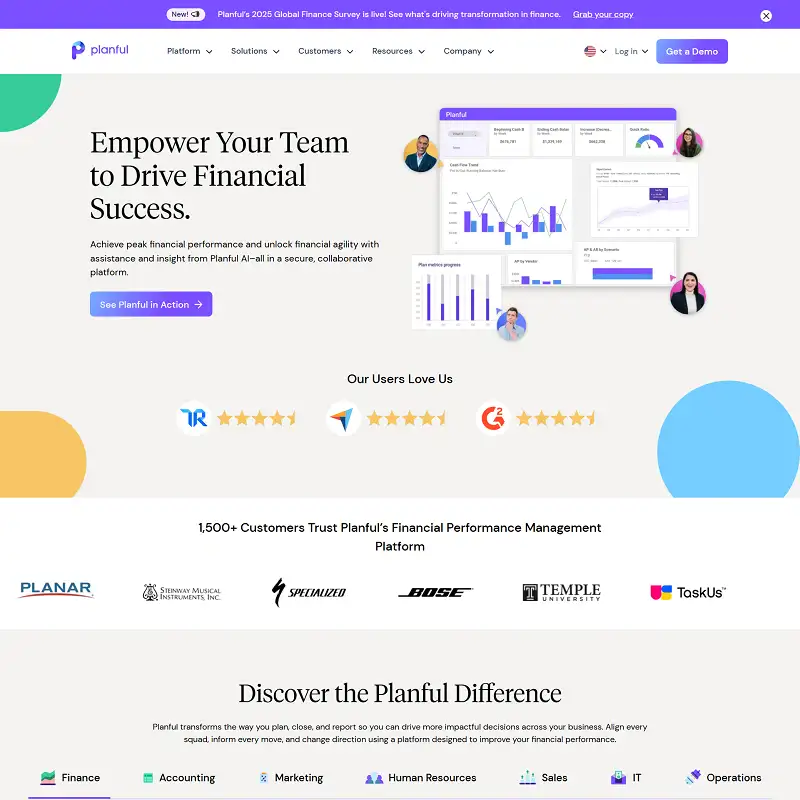

In today’s fast-paced business environment, companies need more than spreadsheets to plan, budget, and forecast effectively. Managing finances manually can lead to errors, wasted time, and missed opportunities. Enter Planful — a cloud-based platform that helps organizations modernize financial planning, budgeting, and analysis for smarter decision-making.

Trusted by businesses of all sizes, Planful transforms complex finance processes into automated, collaborative, and insightful workflows, enabling finance teams to focus on strategy rather than data entry.

What Is Planful?

Planful (formerly Host Analytics) is a cloud-based financial planning and analysis (FP&A) platform that enables organizations to streamline budgeting, forecasting, consolidation, and reporting.

Its mission is clear: to empower finance teams to drive business performance with real-time insights and streamlined workflows. Planful replaces cumbersome spreadsheets and disconnected systems with a single, unified platform for smarter financial management.

Key Features of Planful

Planful offers a comprehensive suite of tools to optimize financial operations:

- Budgeting and Forecasting: Create accurate budgets and flexible forecasts with scenario modeling.

- Financial Consolidation: Combine multiple entities and accounts into a single view for reporting.

- Reporting and Analytics: Generate customizable, real-time reports for executives and stakeholders.

- Collaboration Tools: Enable finance teams, department heads, and executives to collaborate seamlessly.

- Workflow Automation: Reduce manual tasks and increase accuracy in budgeting and reporting.

- Integration Capabilities: Connect with ERP systems like NetSuite, SAP, and Oracle.

- Scenario Planning: Analyze “what-if” scenarios to anticipate changes in business conditions.

These features give finance teams the ability to plan, analyze, and report faster and more accurately.

How Planful Works

Planful works by consolidating financial data from multiple sources into a centralized cloud platform. This allows finance teams to create budgets, track actual performance, and generate reports in real time.

Users can build forecasts using historical data, input from departments, and predictive analytics. Automated workflows reduce manual errors, and collaborative tools ensure all stakeholders have access to the information they need.

The platform’s dashboards and reporting tools provide clear insights into financial health, helping leaders make informed decisions quickly.

Why Businesses Choose Planful

Businesses choose Planful because it combines automation, accuracy, and collaboration in a single platform.

It’s particularly valuable for organizations that:

- Require accurate budgeting and forecasting across multiple departments or subsidiaries.

- Want to replace manual spreadsheets with automated workflows.

- Need real-time insights to make data-driven business decisions.

- Seek collaboration between finance teams and business stakeholders.

By streamlining financial processes, Planful allows companies to focus on strategy, growth, and performance rather than administrative tasks.

Pros and Cons of Planful

Pros:

- Cloud-based platform with real-time data access.

- Automates budgeting, forecasting, and reporting workflows.

- Integrates with major ERP systems.

- Enables collaborative financial planning across teams.

- Provides scenario modeling and predictive analytics.

Cons:

- Can be complex to implement for smaller businesses.

- Higher cost compared to simpler budgeting tools.

- Some advanced features may require training for optimal use.

Planful vs. Competitors

Compared to competitors like Adaptive Insights or Anaplan, Planful stands out for its ease of use, collaborative features, and automation. While Anaplan is geared toward large enterprises and Adaptive Insights focuses heavily on modeling, Planful balances robust functionality with user-friendly design, making it suitable for mid-size and enterprise companies alike.

Final Thoughts

Planful modernizes financial planning and analysis by providing automation, collaboration, and actionable insights in one platform. By reducing reliance on spreadsheets and disconnected systems, it enables finance teams to work smarter, plan accurately, and drive business performance.

For organizations looking to streamline budgeting, forecasting, and reporting, Planful offers a reliable, modern solution that makes finance a strategic advantage.

Collaborative. Automated. Insightful. That’s Planful.

No Comments

Leave a comment Cancel