In the world of business insurance, trust and stability matter more than anything else. For over two centuries, The Hartford has embodied both — protecting companies of every size from unexpected loss and helping them rebuild when disaster strikes. From humble beginnings in 1810 to becoming one of the most respected insurers in the United States, The Hartford’s legacy is one of commitment, resilience, and reliability.

What Is The Hartford?

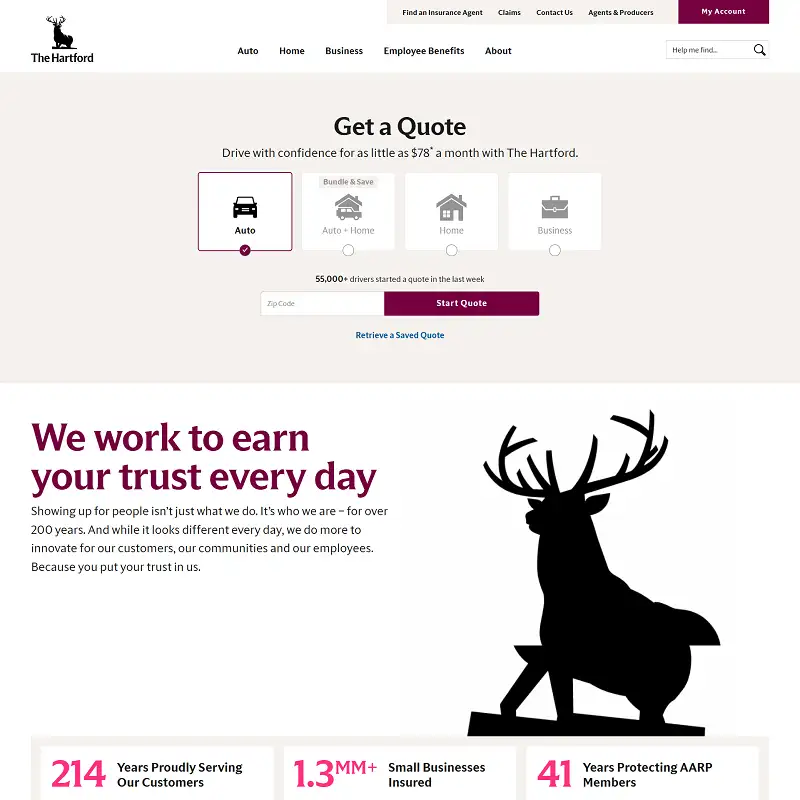

The Hartford Financial Services Group, Inc., commonly known as The Hartford, is a leading provider of business, home, auto, and employee insurance solutions. Based in Hartford, Connecticut, the company has built a stellar reputation for delivering comprehensive coverage, excellent customer service, and quick claims handling.

Over the years, The Hartford has become particularly popular among small and medium-sized businesses for its dependable business insurance packages and worker protection programs.

What The Hartford Offers

The Hartford’s range of products covers nearly every business and personal insurance need:

- Business Insurance: General liability, workers’ compensation, property insurance, and more.

- Commercial Auto Insurance: Coverage for business vehicles and fleets.

- Employee Benefits: Group life, disability, and accident insurance plans.

- Home and Auto Insurance: Personal coverage options available through AARP partnerships.

- Specialty Insurance: Professional liability, data breach, and industry-specific solutions.

Each of these offerings is designed to help policyholders minimize risk and recover quickly from unexpected financial challenges.

How The Hartford Works

When you partner with The Hartford, you get more than a policy — you get a proactive risk management partner. Businesses can easily request quotes, customize coverage, and manage policies online. The Hartford’s claims process is known for being efficient, transparent, and fair, helping customers get back on their feet as quickly as possible.

The company’s risk engineering services also provide guidance on workplace safety, compliance, and loss prevention — giving businesses the tools to prevent problems before they occur.

In short, The Hartford isn’t just there when things go wrong — it’s there to help make sure they don’t.

Why Businesses Choose The Hartford

There’s a reason The Hartford remains one of the top insurance providers for U.S. businesses. Its combination of strong financial stability, deep industry expertise, and customer-first mindset makes it stand out from competitors.

Businesses choose The Hartford because:

- It offers customized insurance plans for different industries.

- The claims process is fast, reliable, and easy to manage online.

- Its reputation spans over 200 years of consistent performance.

- It provides exceptional customer service and educational resources for business owners.

From construction and retail to tech startups and healthcare providers, The Hartford adapts its coverage to the specific risks of each field — ensuring true peace of mind.

Pros and Cons of The Hartford

Pros:

- Over 200 years of experience and strong financial ratings.

- Tailored insurance solutions for small and large businesses.

- Excellent claims handling and customer support.

- Comprehensive online tools and account management.

- Trusted AARP partnership for personal insurance.

Cons:

- May be more expensive than smaller insurance providers.

- Some specialized coverages available only through agents.

- Fewer options for international coverage.

Final Thoughts

With a heritage that stretches back to 1810, The Hartford remains one of America’s most trusted and enduring insurance brands. Its unwavering focus on customer service, risk management, and business protection has made it a cornerstone of financial security for generations.

Whether you’re running a small business or managing a large enterprise, The Hartford delivers the strength, reliability, and protection you need to face the future with confidence.

For companies that value trust and longevity, The Hartford isn’t just an insurer — it’s a partner for success.

No Comments

Leave a comment Cancel