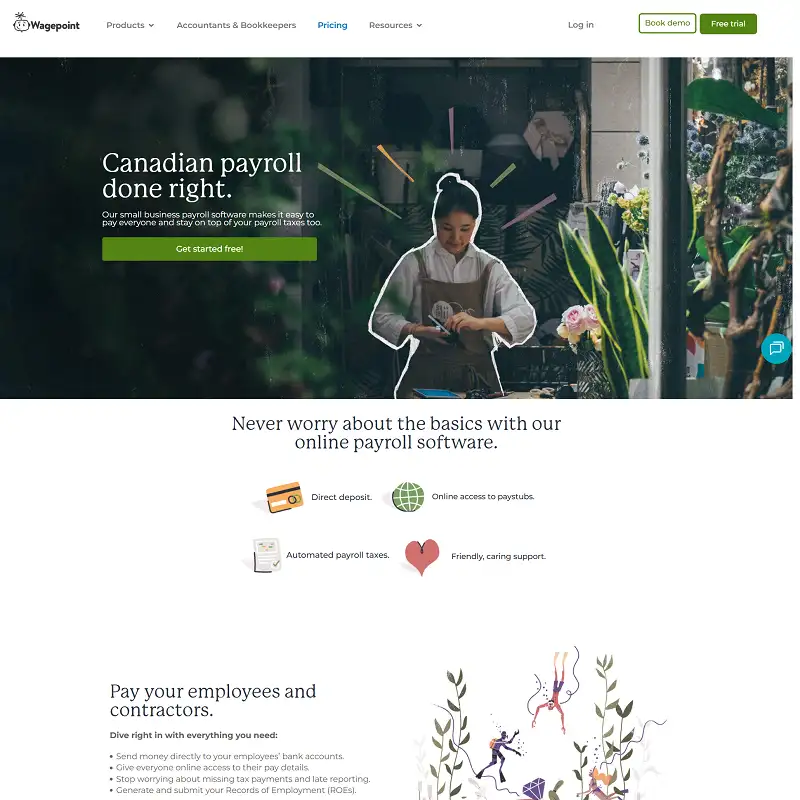

Payroll can be one of the most time-consuming and stressful aspects of running a business. From calculating taxes to issuing paychecks, even small mistakes can have big consequences. That’s why Wagepoint exists — to make payroll simple, accurate, and stress-free for small businesses.

Since its inception, Wagepoint has focused on helping small business owners spend less time on payroll and more time on growth. Its intuitive platform makes managing employee pay, taxes, and compliance straightforward and efficient, even for those without a background in accounting.

What Is Wagepoint?

Wagepoint is a cloud-based payroll software designed specifically for small businesses in the United States and Canada. It handles payroll processing, tax filings, and compliance management — all through a user-friendly online platform.

Unlike traditional payroll systems that require manual calculations or complex software setups, Wagepoint aims to simplify payroll for small business owners, letting them run payroll in minutes rather than hours.

Key Features of Wagepoint

Wagepoint offers a variety of features that streamline payroll for small businesses:

- Automatic Payroll Processing: Schedule pay runs and automatically calculate employee wages, deductions, and taxes.

- Tax Filing and Remittance: Automatically file federal, state, and provincial taxes.

- Direct Deposit: Pay employees quickly and securely.

- Employee Self-Service: Employees can view pay stubs, tax forms, and payment history online.

- Time Tracking Integration: Sync with popular time tracking tools to streamline payroll.

- Compliance Assistance: Ensure payroll meets all federal and local regulations.

- Mobile Access: Run payroll and manage employee information from anywhere.

With these tools, Wagepoint reduces the risk of errors and ensures employees are paid accurately and on time.

How Wagepoint Works

Wagepoint works by consolidating payroll tasks into a single online platform. Once you set up employee information and connect your bank account, payroll can be processed in just a few clicks.

The software automatically calculates wages, deductions, and taxes, then deposits payments directly into employees’ bank accounts. Wagepoint also handles tax filings and remittances, eliminating the need for manual submissions or spreadsheets.

Employees can access a self-service portal to view pay history, download tax forms, and manage personal information — reducing administrative overhead for HR staff.

Why Businesses Choose Wagepoint

Small businesses choose Wagepoint because it combines simplicity with reliability. For entrepreneurs without dedicated HR or payroll teams, Wagepoint eliminates the complexity of payroll compliance while ensuring employees are paid accurately and on time.

It’s particularly valued by businesses that:

- Want a fast, easy payroll solution without complicated software.

- Need automatic tax calculations and filings.

- Seek a cloud-based platform accessible from anywhere.

- Value direct deposit and employee self-service features.

By taking the headache out of payroll, Wagepoint allows small business owners to focus on growth and operations.

Pros and Cons of Wagepoint

Pros:

- Extremely user-friendly and easy to set up.

- Automatic payroll and tax filing for peace of mind.

- Direct deposit ensures timely employee payments.

- Employee self-service reduces administrative workload.

- Supports integration with popular accounting and time tracking tools.

Cons:

- Limited features for large enterprises.

- Pricing may be higher for very small teams with only a few employees.

- Customer support can sometimes be slower during peak periods.

Wagepoint vs. Competitors

Compared to other payroll providers like Gusto, ADP, or OnPay, Wagepoint stands out for its focus on simplicity and small business needs. While Gusto and ADP offer more advanced HR features, Wagepoint is ideal for small businesses that want fast, reliable payroll without unnecessary complexity.

Final Thoughts

Wagepoint is a small business payroll solution designed to save time, reduce errors, and simplify compliance. By automating calculations, payments, and tax filings, it empowers business owners to focus on growing their business instead of wrestling with payroll.

For small businesses looking for an intuitive, reliable, and cloud-based payroll platform, Wagepoint is a smart choice.

Simple. Accurate. Stress-Free. That’s Wagepoint.

No Comments

Leave a comment Cancel