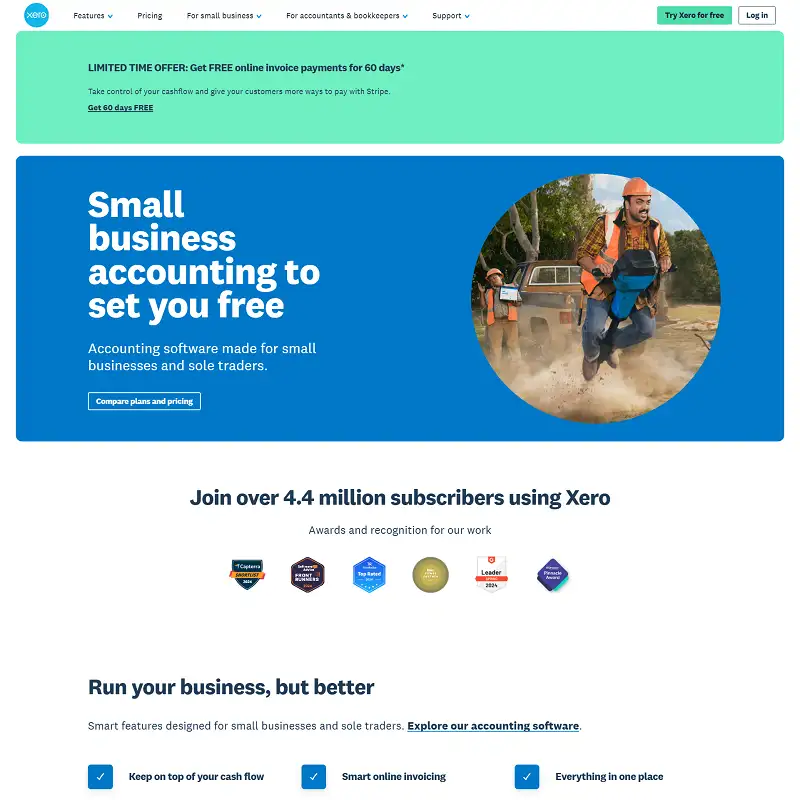

Running a business isn’t just about making sales — it’s about knowing where every dollar goes. Yet for many entrepreneurs, managing books, invoices, and cash flow can feel overwhelming. That’s exactly the problem Xero set out to solve.

Built for small businesses that want simplicity without sacrificing power, Xero has redefined accounting software. It turns complex financial management into something intuitive, connected, and even enjoyable — so business owners can focus less on spreadsheets and more on growth.

What Is Xero?

Xero is a cloud-based accounting software designed to help small and medium-sized businesses manage their finances efficiently. Founded in New Zealand in 2006, Xero has become one of the world’s leading accounting platforms, used by over 3.5 million subscribers across 180 countries.

Unlike traditional accounting systems that require desktop installations and constant updates, Xero works entirely online — offering flexibility, collaboration, and real-time insights from any device.

Its mission is simple yet powerful: to make accounting beautiful.

Key Features of Xero

What makes Xero stand out is its ability to combine simplicity with smart automation. Here are some of the most valuable features business owners love:

- Automated Bank Reconciliation: Connect your bank accounts and reconcile transactions with a single click.

- Invoicing: Create, send, and track invoices in minutes.

- Expense Management: Capture receipts on the go using your phone camera.

- Inventory Tracking: Monitor stock levels and cost of goods sold easily.

- Payroll Integration: Manage employee payments and taxes from one platform.

- Reporting & Analytics: Get real-time financial reports and performance insights.

- Multi-Currency Support: Perfect for businesses operating globally.

With these features, Xero makes financial clarity accessible to everyone — even those who aren’t accountants.

How Xero Works

Using Xero is as simple as logging in, connecting your business accounts, and letting automation do the heavy lifting.

Once connected, the software automatically pulls in bank transactions, allowing users to categorize expenses, track cash flow, and monitor invoices in real time. You can also invite your accountant or bookkeeper to collaborate — meaning no more emailing spreadsheets back and forth.

The dashboard gives you a live snapshot of your business health — from revenue and outstanding invoices to overdue bills — all displayed in clean visuals.

In short, Xero keeps your finances in sync, so you stay one step ahead.

Why Businesses Choose Xero

Businesses choose Xero for its ease of use, automation, and scalability. It’s designed with small business owners in mind — people who don’t have time to decipher complicated accounting jargon.

The software saves hours each week by automating manual tasks like data entry, expense tracking, and report generation. Plus, Xero integrates with over 1,000 third-party apps like Shopify, PayPal, Stripe, and HubSpot — making it a central hub for all your business operations.

For entrepreneurs who value time, transparency, and mobility, Xero feels less like an accounting tool and more like a trusted financial partner.

Pros and Cons of Xero

Pros:

- Clean, user-friendly interface.

- Excellent automation and bank integration.

- Supports multiple currencies and global operations.

- Strong app marketplace for integrations.

- Real-time collaboration with accountants and staff.

Cons:

- Payroll features are limited in some regions.

- Learning curve for users switching from traditional systems.

- Some advanced reporting tools require higher-tier plans.

Xero vs. QuickBooks

While QuickBooks has long been the industry standard, Xero is quickly becoming a preferred alternative for modern businesses. Its intuitive design, multi-user collaboration, and transparent pricing make it ideal for growing startups and international teams.

QuickBooks may have deeper features for accountants, but Xero wins when it comes to simplicity, flexibility, and ease of integration — especially for business owners who want control without complexity.

Final Thoughts

In the modern world of business, financial clarity isn’t optional — it’s essential. Xero empowers entrepreneurs with tools that make managing money not just easier, but smarter.

Whether you’re sending your first invoice, scaling a growing company, or tracking every cent of profit, Xero helps you make confident financial decisions — anytime, anywhere.

Smart. Simple. Seamless. That’s the Xero way.

No Comments

Leave a comment Cancel